auditor independence tax services

Davis County ClerkAuditor PO. Payment status as of January 31 2022.

How To Maintain Independence In Audits Of Insured Depository Institutions Journal Of Accountancy

As with other kinds of appointment letters such as contractor appointment letters there are some tips that you can use yourself in order to make your letters more effectiveAside from making them more effective at their jobs these tips can also serve to ensure that your letters conform to basic standards which would make them.

. Chafee Foster Care Independence Program. The primary was scheduled for August 2 2022. Residents can contact our office at 740-699-2130.

O Part 4A Independence for Audit and Review Engagements which applies when. 2022 County Tax Sale Information. Internal Auditor Resume Samples and examples of curated bullet points for your resume to help you get an interview.

You can purchase a copy of the. Human services and mental health accomplishments offers me the ability to effectively address our communities pressing needs that have been identified through my eight-month visit to all of the 12000-plus homes in our Legislative District over the past. Information Lookup Services Property Tax Information Lookup.

435 634-5703 If a property owner or a property owners spouse claims a residential exemption under Utah Code Ann. Aging. For the income based tax relief programs Circuit Breaker CountyIndigent Abatement liquid asset balances are not to exceed 20 times the prior year property tax amount.

Washington DC January 22 2003-- The Securities and Exchange Commission today voted to adopt rules to fulfill the mandate of Title II of the Sarbanes-Oxley Act of 2002 strengthen auditor independence and require additional disclosures to investors about the services. Rebecca Greene - Manager Auditor Controller 5530 Overland Avenue Suite 410 San Diego CA 92123 Phone. Not including retirement accounts.

Commission Adopts Rules Strengthening Auditor Independence FOR IMMEDIATE RELEASE 2003-9. The Independent Living IL Program is funded with Title IV-E state and local funds. We strive to provide our services with outstanding customer service while providing the public with access to accurate and reliable public information.

2021 Tax Year Lookup Service. 858 694-2922 MS O-53. Maintaining independence has a number of aspects that the auditor must be mindful of throughout the clientauditor relationship.

You can utilize the INFO section on the upper right to view information on the various services offered by this office and access the numerous forms required. The AICPA Audit Guide Government Auditing Standards and Single Audits GAS-SA Guide issued annually presents guidance on the audits of financial statements conducted in accordance with the 2018 edition of Government Auditing Standards also referred to as the Yellow Book. Auditor Appointment Letter Guidelines.

A member in public practice shall be independent in the performance of professional services as required by standards promulgated by bodies designated by Council. Financial services experience is preferable including an understanding of asset management products business processes and risk and controls systems. Material that applies to registered auditors when providing professional services.

33-8183 January 28 2003Strengthening the Commissions Requirements Regarding Auditor Independence states that there is a rebuttable presumption that certain prohibited non-audit services eg bookkeeping financial information systems design and implementation will be subject to. Independence Integrity and Objectivity. View Contact Page.

A member provides tax or PFP services for several members of a family who may have opposing interests. The Department of Human Services DHS Office of Children Youth and Families OCYF is the single state agency designated to administer and supervise the Chafee Foster Care Independent Program CFCIP. Concerns about independence are not new.

Missouri is holding an election for state auditor on November 8 2022. Assistance for entities impacted by COVID-19 is funded by Board of Supervisors allocated federal American Rescue Plan Act ARPA funding. Tax and tax compliance services.

Application for Residential Exemption or Request a paper application via. Conflict of interest situations. Please also feel free to contact our office regarding related questions.

59-2-1035 for property in this state that is the primary residence of the property owner or the property owners spouse that claim of a. For the income based tax relief programs Circuit Breaker CountyIndigent Abatement no other real estate property will be allowed. Preparation of tax forms Member states can allow the provision of tax services relating to i iv v vi and vii comprehensively as long as.

A member has a significant financial interest is a member of management or is in a position of influence in a company that is a major competitor of a client for which the member performs management consulting services. Expressed Concerns about Independence. Use this website to look up any property to view its tax appraisal and payment history and you can run reports of recent sales.

2022 Tax Year Lookup Service Current Tax Year. As adopted January 12 1988 Interpretations under Rule 101 Independence. Values as of January 1 2021.

A brief overview of the areas an auditor must be aware of and implement appropriate responses to include. General requirements including the provision of certain non-audit services and. Placing the auditors opinion in the first paragraph of the report is designed to help readers of your financial statements better understand the results of the.

858 694-2901 Fax. Send a Message Call. Prohibition of certain non-audit services NAS to PIEs Article 51 of the Regulation Prohibited non-audit services the blacklist a.

The Commissions 2003 adopting release Release No. 1 Emphasis on the Auditors Opinion and Independence In the new report format the auditors opinion will be front and center followed by the basis of the auditors opinion. Harvey Hendriksen wrote that when he was at the SEC he noticed that auditors called meetings with the chief accountant when they were unable or unwilling to exercise professional judgment Relevant Financial Reporting Questions Not Asked by the Accounting Profession.

The filing deadline was March 29 2022. Cindi Henry Belmont County Auditor. Part 4 Independence Standards which sets out additional material that applies to registered auditors when providing assurance services as follows.

Maintain independence and objectivity complying personally with all. ET Section 101 Independence01. Welcome to the Pickaway County Auditor Website.

It also includes recommendations for the conduct of single audits. The Community Enhancement Program funding comes from a set percent of Transient Occupancy Tax TOT revenues. Parcels as of January 1.

Box 618 Farmington Utah 84025.

Et Section 101 Independence Pcaob

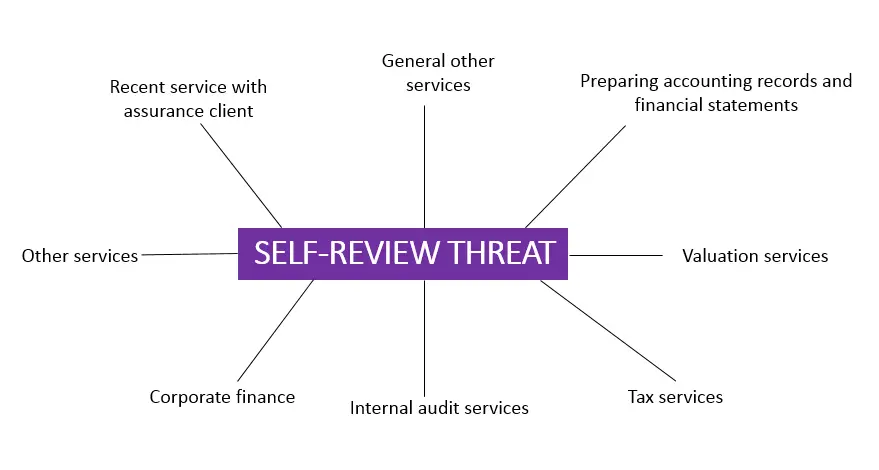

Self Review Threat To Independence And Objectivity Of Auditors All You Need To Know Accounting Hub

Insurance Auditing Tax Advisory Services Johnson Lambert

Mandatory Audit Firm Rotation And Prohibition Of Audit Firm Provided Tax Services Evidence From Investment Consultants Perceptions Aschauer 2018 International Journal Of Auditing Wiley Online Library

The Importance Of Independence Of Your Auditor Exceed

Non Audit Fees Among S P 500 Non Audit Fees Among S P 500 Audit Analyticsaudit Analytics

Non Audit Fees Among S P 500 Non Audit Fees Among S P 500 Audit Analyticsaudit Analytics

Et Section 101 Independence Pcaob

Building On Our Audit Quality Foundations Kpmg Global

Now Is The Time To Operationally Split Audit And Nonaudit Services The Cpa Journal

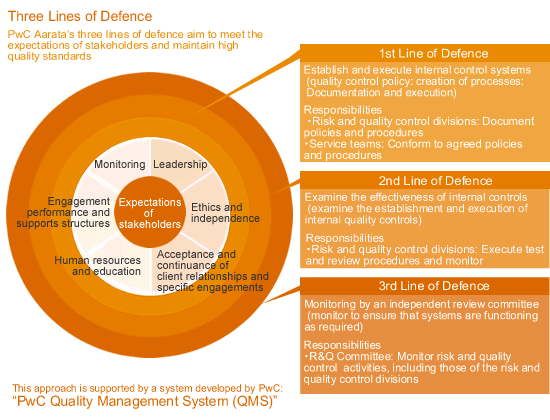

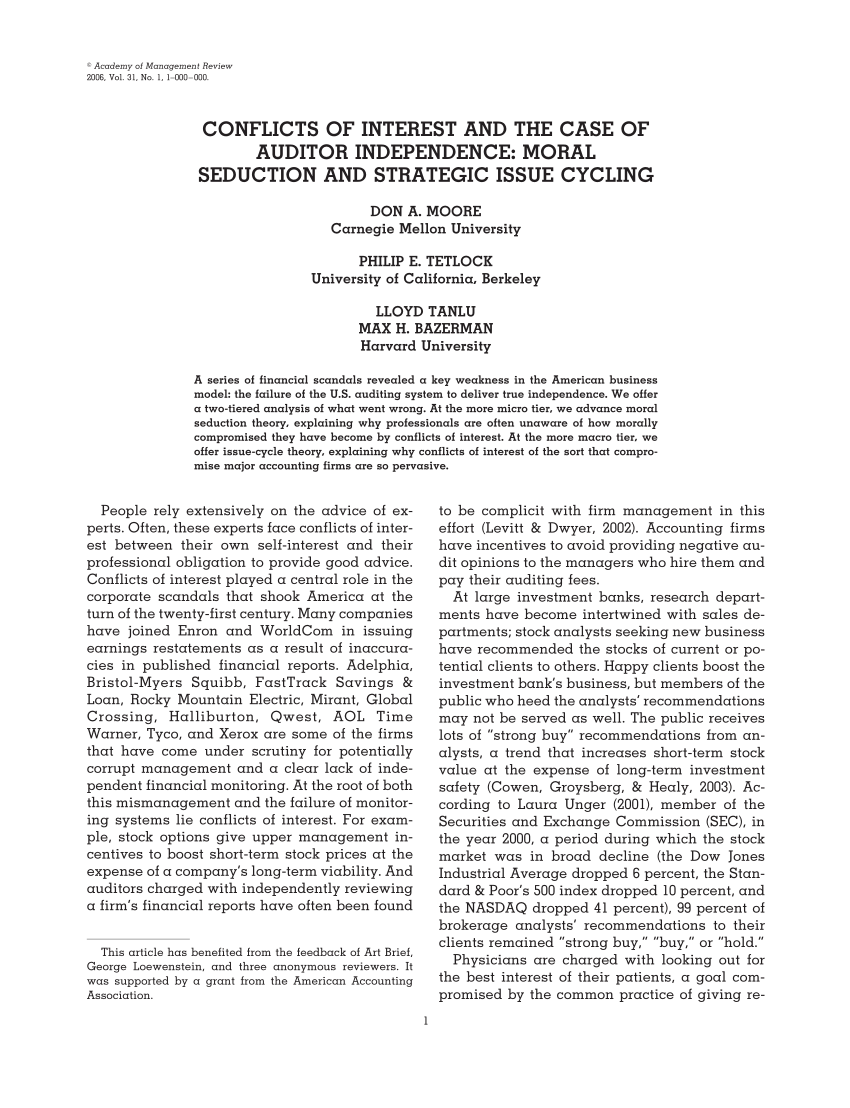

Pdf Conflicts Of Interest And The Case Of Auditor Independence Moral Seduction And Strategic Issue Cycling

Now Is The Time To Operationally Split Audit And Nonaudit Services The Cpa Journal

Accounting And Auditing Regulatory Structure U S And International Everycrsreport Com

Sec Amends Certain Auditor Independence Requirements Grant Thornton